Meme stock melee: do GameStop jobs match their recent stock rally?

Shares of GameStop ($GME) skyrocketed this week, spurred by a coordinated effort by investors on Reddit. The hugely popular subreddit r/WallStreetBets (WSB) has over 2 million members, composed largely of Millennial and GenZ men.

Shares of GameStop ($GME) skyrocketed this week, spurred by a coordinated effort by investors on Reddit. The hugely popular subreddit r/WallStreetBets (WSB) has over 2 million members, composed largely of Millennial and GenZ men. Its recent focus on the old school video game retailer has blown up into an epic battle between individual investors and traditional hedge funds–and one recent calculation shows these hedge funds down a collective $25 billion short-selling $GME.

In the midst of the mayhem, online brokerages Robinhood and Interactive Brokers barred trading of GameStop stocks, as well as other WSB picks also seeing major jumps. AMC Entertainment, BlackBerry and Bed Bath & Beyond, who also experienced gains as a result of the Reddit rally, are among others newly barred from the very platforms that helped facilitate the spikes. On the heels of these decisions, shares of GameStop have dropped more than 40% as of Friday morning.

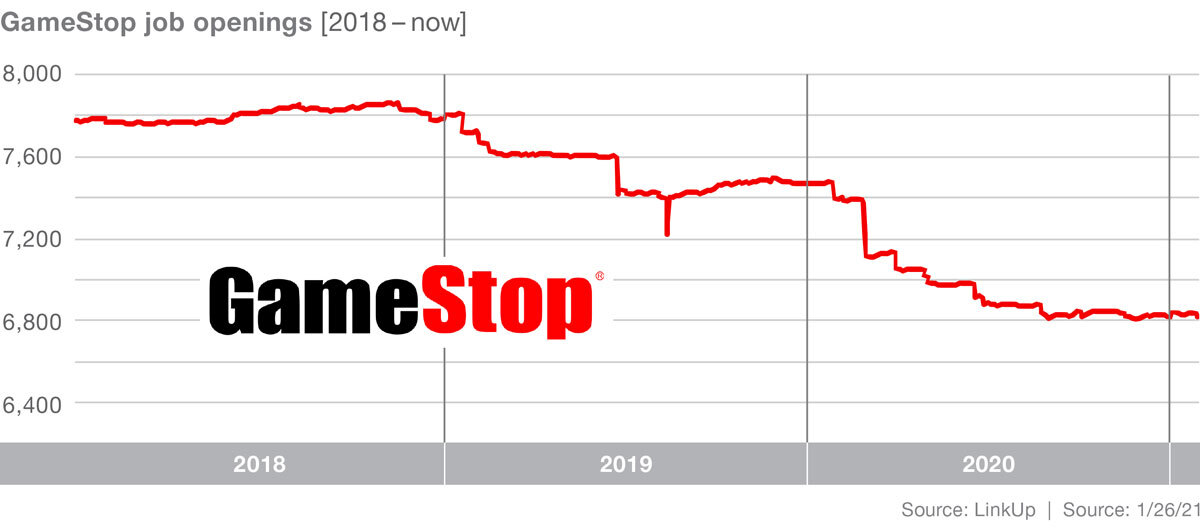

GameStop popped up on r/WallStreetBets around 2 years ago, but the explosion witnessed in January has been building over the last 12 months. We dug into GameStop’s job openings data using LinkUp RAW to examine the long term trajectory, and see whether recent numbers have shifted along with their soaring stock price.

Overall, GameStop job openings are down about 12% since January 2018, with listings dropping 8.5% in 2020. While GameStop hiring has fared better than some businesses, it didn’t see noticeable gains during COVID recovery that occurred over the summer.

While the long-term implications of the GameStop saga remain to be seen, the current news cycle is bringing updates at a head-spinning rate. We will continue to monitor them, along with GameStop’s jobs data, as we track this rapidly unfolding story.

Insights: Related insights and resources

-

Blog

01.11.2022

ESG investing on the rise

Read full article -

Blog

10.11.2021

EVs steering Ford’s future

Read full article -

Blog

04.01.2021

Answering sustainability questions with employment data

Read full article

Stay Informed: Get monthly job market insights delivered right to your inbox.

Thank you for your message!

The LinkUp team will be in touch shortly.